child tax credit portal

Non-tax filers including those with no or very little income are eligible for the 2021 credit. March 2021 marked a historic moment.

By making the Child Tax Credit fully refundable low- income households will be.

. The credit amount was increased for 2021. The White House recently promoted an online tool allowing low-income Americans to arrange to collect their child tax credit payments. With the new portal families can claim up to 3600 per child younger than six and up to 3000 for each child aged.

FAMILIES can now use an online portal to claim up to 3600 per child in advance child tax credits. The amount you can get depends on how many children youve got and whether youre. The credit amounts were increased to 3600 per child under 6 and 3000 per child age 6-17 for most families.

The Biden administration has initiated the new online portal to ensure low-income parents that didnt file tax returns can get their hands on the credits. A childs age determines the amount. The CTC web tool GetCTC that the Internal Revenue Service IRS suspended earlier this year is again operational.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Although the Child Tax Credit gives taxpayers up to 3600 per child the Child and Dependent Care Credit could be worth up to 8000 for a family with two or more children or dependents. The credit was made fully refundable.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Details about any changes to your circumstances. Back in 2021 for couples making less than 150000 dollars or singles making less than 75000 dollars the full 3600 dollar Child Tax Credit was.

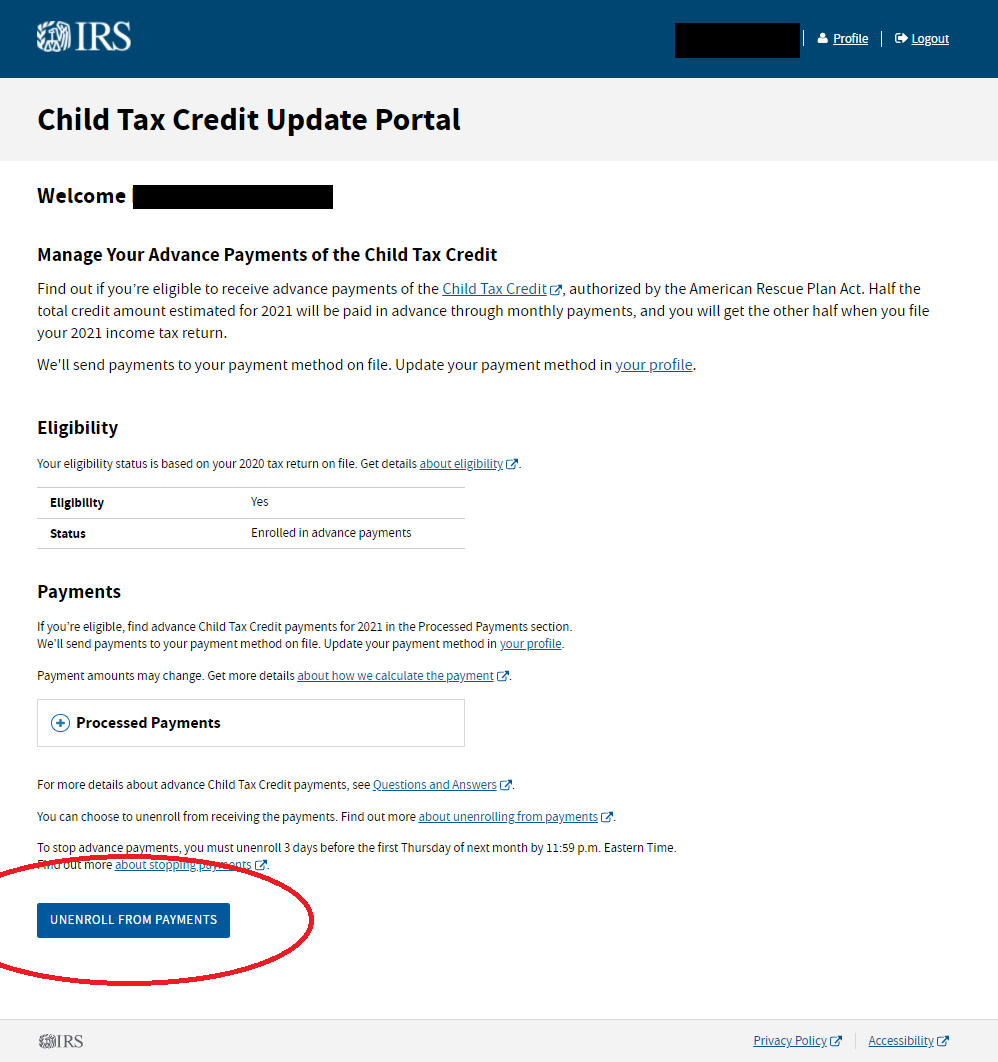

An online portal designed to help very low-income people get the expanded Child Tax Credit reopened Wednesday according to the nonprofit group that designed it. To check your eligibility refer to the Eligibility section on the main page of the Child Tax Credit Update Portal. This means that instead of receiving monthly payments of say 300 for your 4-year.

Half of the money will come as six monthly payments and. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Biden administration reups Child Tax Credit portal.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. Simplifed tax filing with GetCTC will be available in May or you can file a.

Making a new claim for Child Tax Credit. By Stephen Silver. When President Joe Biden enacted the 19 trillion American Rescue Plan Act in March 2021 the legislation provided eligible parents as much as 3600 for a child under the age of six and up to.

It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000.

The CCB may include the child disability benefit and any related provincial and territorial programs. The American Rescue Plan became law and expanded the Child Tax Credit. Get your advance payments total and number of qualifying children in your online account.

You and your partners. The Child Tax Credit helps all families succeed. You can check all the details regarding Child Credit Tax Update Portal from this page.

Some families received advance monthly payments of the credit during the last 6 months. Check your eligibility and direct deposit information. You will be able to see if your eligible for advance payments.

Even though filing season has ended the portal was relaunched to give households who qualify for the expanded CTC a chance to receive the full tax return. In the first box. Parents income matters too.

That budget includes more than 600 million in tax cuts amounting to the largest tax reduction in Connecticuts history. The expansion is expected to cut child poverty nearly in halfand its the largest child tax credit in American history. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

The Canada child benefit CCB is administered by the Canada Revenue Agency CRA. You can claim your CTC when you file taxes in 2022. The Child Tax Credit provides money to support American families helping them make ends meet.

The American Rescue Plan Act expands who is eligible to receive the Child Tax Credits cash payments and provides advance automatic monthly. Enter your information on Schedule 8812 Form 1040. As per IRS Child Tax Credit Portal parents and caretakers get half amount in advance in 2021 and half when they file taxes.

Sign up to receive a message as soon as the simplified filing portal is ready. The 2022 Connecticut Child Tax Rebate was created as part of the fiscal year 2023 budget adjustment bill that was signed into law by Governor Lamont. Child Tax Credit CTC Portal 2022 Login Dates.

You can use this service to renew your tax credits after youve received your renewal pack in the post. Already claiming Child Tax Credit. To reconcile advance payments on your 2021 return.

Claim Your Child Tax Credit GetCTC is launching soon. So it means you do not need to file taxes to get Child Tax Credit Advance Payments. Office of Governor Ned Lamont.

But now per a new report the White House. The Child Tax Credit CTC was expanded for 2021. The IRS will pay 3600 per child to parents of young children up to age five.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

2021 Child Tax Credit What It Is How Much Who Qualifies Ally